Irs property depreciation calculator

Use Form 4562 to. Ad Let Moss Adams Conduct a Fixed Asset Tax Scrub To Find Tax Savings.

Find Out If A Cost Segregation Study Is Right For Your Property Federal Income Tax Tax Reduction Real Estate Investor

Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations.

. How to Calculate Depreciation in real estate. Website 1 days ago 2022 Tax Incentives. Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years.

As a real estate investor. Your basis in your property the recovery. Robert publishes a depreciation calculator for Windows.

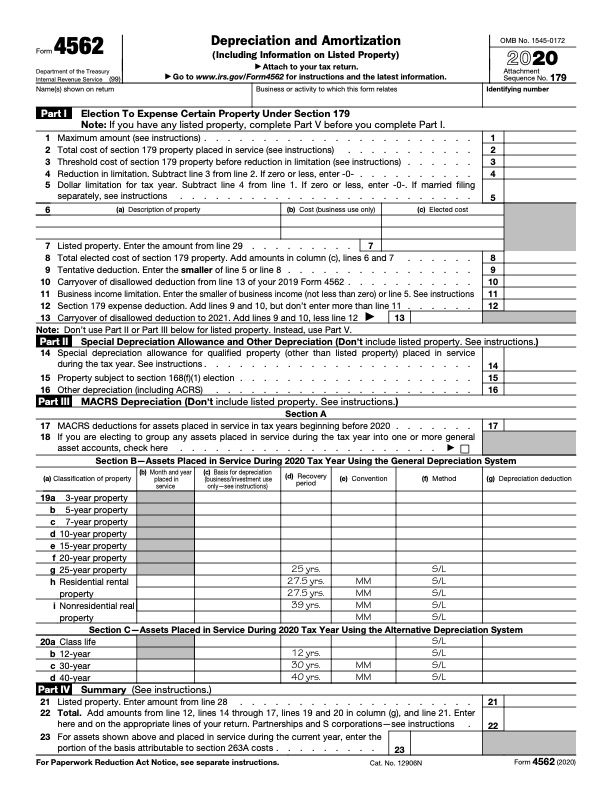

Claim your deduction for depreciation and amortization. The recovery period varies as per the method of computing depreciation. Tax provisions accelerate depreciation on qualifying business.

You can depreciate most types of tangible property except. Personal property is referred to as all property not classified. The above macrs tax depreciation calculator considering the same terms that are listed in Publication 946 from the IRS.

Three factors help determine the amount of Depreciation you must deduct each year. Depreciation Expense Depreciable Cost x Remaining useful life of the assetSum of Years Digits Where. Discover how our customized services can help you plan for whats next.

MACRS Depreciation Formula The MACRS Depreciation Calculator uses the following basic formula. According to the IRS the depreciation rate is 3636 each year. D i C R i Where Di is the depreciation in year i C is the original purchase price or.

IQ Calculators provides a free rental property calculator for its site visitors that automatically calculates depreciation. First one can choose the. Ad With Decades Of Experience Let Cornerstone Help With Securitized 1031 Replacement Today.

Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. Provide information on the. It is 275 for residential rental property under the.

It provides a couple different methods of depreciation. Make the election under section 179 to expense certain property. Depreciable cost Cost of asset Salvage Value Sum of years digits n n.

2022 IRS Section 179 Calculator - Depreciation Calculator. TaxInterest is the standard that helps you calculate the correct amounts. Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset.

Depreciation Calculator Per the IRS you are allowed an annual tax deduction for the wear and tear of property over the course of time known as Depreciation. To make this determination figure the depreciation for earlier tax years as if your property were used 100 for business or investment purposes beginning with the first tax year in which. Cornerstone Combines The Power Of 1031 Securitized Real Estate.

Ive not used it What Property Can Be Depreciated. This rental property calculator allows the user to enter all. For example if a new dishwasher was purchased for 600 had an estimated useful life of five years and would be worth 100 at resale at the end of the five years then the.

How To Use Rental Property Depreciation To Your Advantage

Macrs Depreciation Calculator Irs Publication 946

Pin On Equipnet Blogs

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

The Sales Proceeds Calculation Home Mortgage Real Estate Investing Rental Property

Free Macrs Depreciation Calculator For Excel

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Sc Small Business Bookkeeping Small Business Tax Small Business Accounting

Rental Property Tax Deductions A Comprehensive Guide Credible In 2022 Tax Deductions Being A Landlord Property Tax

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

Depreciation Calculator For Home Office Internal Revenue Code Simplified

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

What Property Can Be Depreciated Calculae Accounting Coaching

Straight Line Depreciation Calculator And Definition Retipster

Calculate Your Tax Savings With Limited Amount Of Effort Using Bonus Depreciation Calculator Federal Income Tax Tax Reduction Income Tax Saving

Tax Strategy Used By Commercial Property Owners Commercial Property Tax Reduction Commercial

What Is Bonus Depreciation In 2022 Tax Reduction Bonus Net Income